GST Registration & Filings Made Easy

Get your GST registered hassle-free and file your returns accurately.

Avoid penalties and ensure smooth business operations.

What is GST?

Goods and Services Tax (GST) is a unified tax system in India, replacing multiple indirect taxes. Any business with a turnover above ₹40 lakhs (₹10 lakhs for special category states) must register for GST.

Why GST Registration is Important?

Legal Compliance – Mandatory for eligible businesses.

Input Tax Credit (ITC) – Claim tax paid on purchases.

Improved Credibility – Helps in business growth and loans.

Avoid Heavy Penalties – Ensure timely registration and filings.

Goods and Services Tax (GST) is a unified tax system in India, replacing multiple indirect taxes. Any business with a turnover above ₹40 lakhs (₹10 lakhs for special category states) must register for GST.

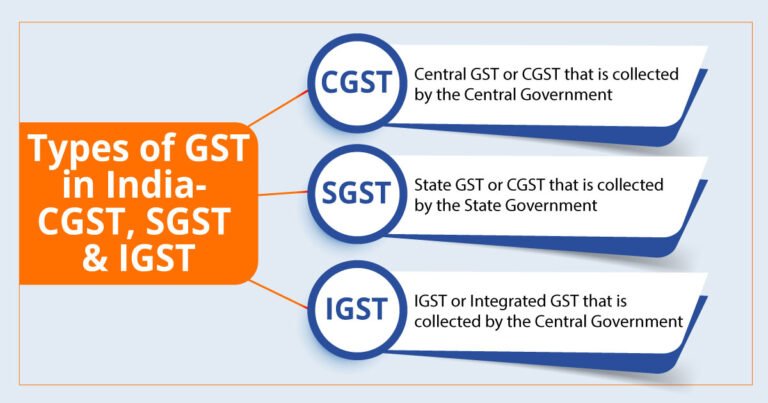

Types of GST Registrations

Legal Compliance – Mandatory for eligible businesses.

Input Tax Credit (ITC) – Claim tax paid on purchases.

Improved Credibility – Helps in business growth and loans.

Avoid Heavy Penalties – Ensure timely registration and filings.

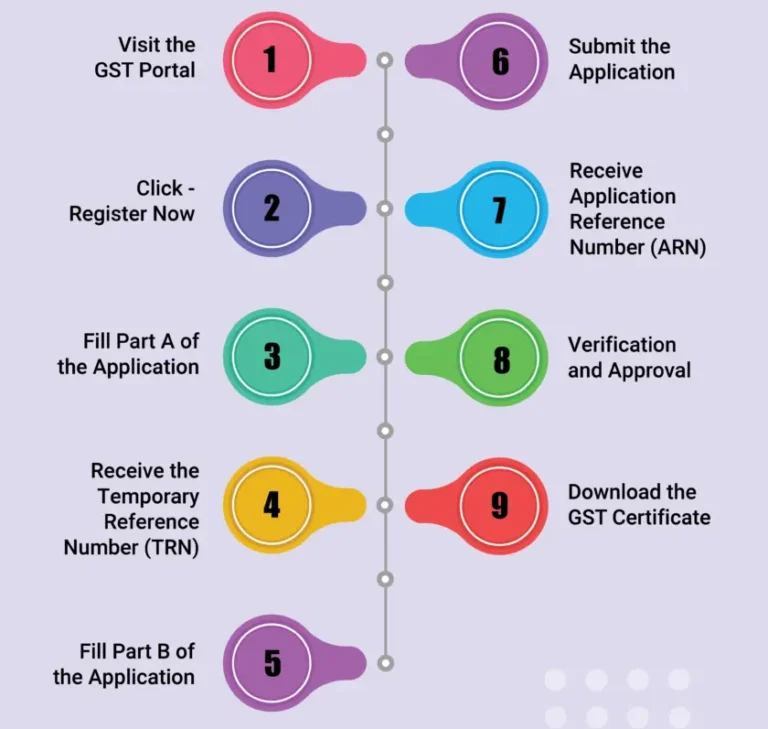

GST Registration Process

Step 1: Collect required documents (PAN, Aadhaar, business details).

Step 2: Submit the application via GST portal.

Step 3: Receive ARN (Application Reference Number).

Step 4: Verification by GST officer.

Step 5: Get GSTIN (GST Identification Number) upon approval.

GST Return Filing Services

- Monthly, Quarterly & Annual GST Filings (GSTR-1, GSTR-3B, GSTR-9, etc.).

- Avoid penalties and interest on late filings.

- Expert support to ensure error-free compliance.

Documents Required for GST Registration

- PAN Card & Aadhaar of proprietor/partners/directors.

- Business Registration Proof (Partnership Deed, Incorporation Certificate, etc.).

- Address Proof (Electricity Bill, Rent Agreement).

- Bank Account Details (Cancelled Cheque, Passbook).

Why Choose Us?

- Quick & Hassle-Free Process – Get your GSTIN without delays.

- Affordable Pricing – Transparent costs with no hidden charges.

- Expert Support – Guidance from professionals at every step.

Any business exceeding ₹40L turnover (₹10L for special states).

Heavy penalties apply for non-registration.

Usually 3-7 working days.

Get GST Registered Today!

- Need Help with GST? Contact our experts today and ensure hassle-free GST compliance!