File Your TDS Return Hassle-Free!

Avoid penalties, stay compliant, and file your TDS returns accurately with expert assistance.

What is TDS Return?

Tax Deducted at Source (TDS) is a mechanism where tax is deducted by the payer before making payments such as salary, rent, professional fees, or contract payments. Businesses and employers must file TDS returns periodically with the Income Tax Department.

Who Needs to File TDS Return?

- Employers deducting TDS on salaries.

- Businesses making payments exceeding the TDS threshold.

- Banks deducting TDS on interest income.

- Property buyers deducting TDS on transactions above ₹50L.

Types of TDS Return Forms

| TDS Return Form | Purpose | Applicable For |

|---|---|---|

| Form 24Q | TDS on Salary | Employers |

| Form 26Q | TDS on Non-Salary Payments | Businesses, Contractors, Professionals |

| Form 27Q | TDS on Foreign Transactions | NRI Payments |

| Form 27EQ | TCS (Tax Collected at Source) | Sellers Collecting Tax |

Benefits of Filing TDS Returns on Time

- Avoid Late Fees & Penalties – ₹200 per day fine for delayed filing.

- Stay Tax Compliant – Avoid legal issues with the Income Tax Department.

- Smooth Financial Transactions – Essential for loans and credit approvals.

- Claim Tax Credit – Helps deductees adjust TDS against their tax liability.

TDS Return Filing Process

Step 1: Collect TDS deduction details and challans.

Step 2: Select the applicable TDS return form.

Step 3: Prepare the TDS return file using a government utility or software.

Step 4: Validate the file with a File Validation Utility (FVU).

Step 5: Upload the return on the Income Tax e-filing portal.

Step 6: Generate Acknowledgment Receipt for future reference.

TDS Return Filing Process

| Quarter | Period | Due Date |

|---|---|---|

| Q1 | April – June | 31st July |

| Q2 | July – September | 31st October |

| Q3 | October – December | 31st January |

| Q4 | January – March | 31st May |

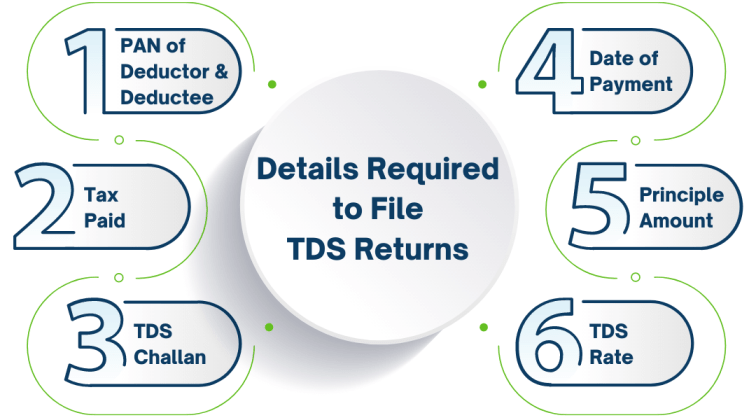

Documents Required for TDS Return Filing

- TAN (Tax Deduction Account Number).

- PAN details of deductor & deductees.

- TDS Challans (Form 16, Form 16A, Form 26AS).

- Salary/Payment details for TDS calculation.

Why Choose Us?

- Expert Assistance – Ensure error-free TDS return filing.

- On-Time Compliance – No risk of penalties.

- Affordable Pricing – Cost-effective solutions for businesses.

- Secure & Hassle-Free Process – End-to-end TDS compliance services.

FAQs on TDS Return Filing

What happens if I miss the TDS return filing deadline?

A late fee of ₹200 per day applies until the return is filed.

How can I check my TDS return status?

You can check it on the TRACES portal.

Can I revise a TDS return?

Yes, if errors are found, a revised return can be filed.

Contact Us

Contact our tax experts now for seamless TDS return filing and compliance!